Financial Aid

Undergraduate Admissions

MNU SCHOOL CODE

007032

Student Financial

aid services

MidAmerica Nazarene University

Lunn Hall

2030 East College Way

Olathe, KS 66062-1899

Office Hours

Mon. – Fri. 8:00am – 5:00pm

- 913-971-3298

- 913-971-3482

- finaid@mnu.edu

STUDENT ACCOUNTS

& CASHIER'S OFFICE

MidAmerica Nazarene University

Lunn Building, First Floor

2030 E. College Way

Olathe, KS 66062-1899

Office Hours

Mon. – Fri. 8:30am – 4:30pm

- 913-971-3504

- studentaccounts@mnu.edu

Tax Information

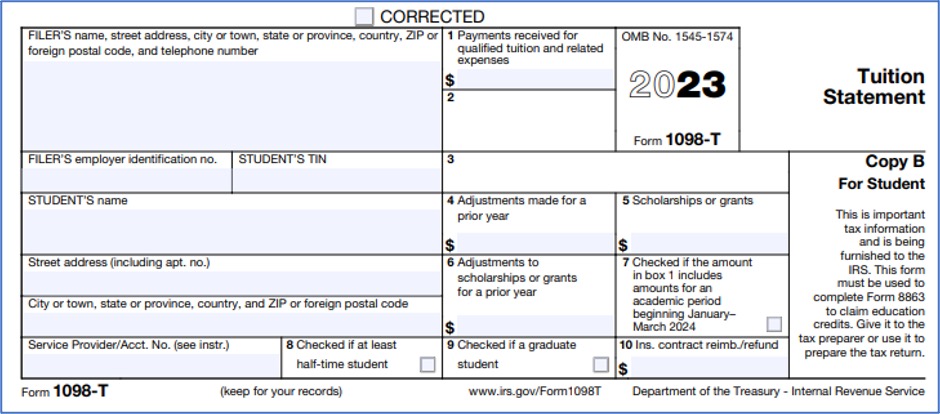

What is a 1098-T?

The 1098-T form reports the amount billed to you by MidAmerica Nazarene University over the course of the previous calendar year. The purpose of the 1098-T is to help you and/or your tax professional determine if you are eligible for the Hope Scholarship Credit or the Lifetime Learning Credit. The 1098-T is just informational; you are not required to attach IRS Form 1098-T to your tax return.

Online Access to 1098-T Forms

MidAmerica Nazarene University offers view access to your 1098-T forms online through our student accounts partner, Self Service Banner. All students eligible for a 1098-T form for the year will be able to see an electronic version of their 1098-T online. MNU may need to get updated tax information from you. If this is the case, please click the link below to print out the W-9 form. Fill out the form and return it to MNU as soon as possible.

1098T Student Tax Form

January 31, 2024: 2023 1098-T forms are available online through Self-Service Banner as follows:

- Go to https://mnu.edu/portal Click Self-Service Banner

- Click on the Enter Secure Area – Login link and log in with your MNU account username and password. Your login is the beginning of your MNU email address. Your password is the last six digits of your social security number unless you have changed it.

- Select the Student Services.

- Select Student Account.

- Select the Tax Notification.

- Enter the Tax Year and click Submit.

A copy of the 1098T Form will come up, as well as the date produced and the detail of how the figures were arrived at.

IMPORTANT NOTICE REGARDING CHANGES TO THE 1098-T REPORTING METHOD FOR TAX YEARS AFTER 2018

The Internal Revenue Service (IRS) has mandated a reporting change affecting IRS Form 1098-T. Starting with tax year 2018, we were required to report Payments Received for Qualified Tuition and Related Expenses. This is recorded in Box 1 of the 1098-T form and is a significant change to the prior year reporting method. We no longer report the Qualified Tuition and Related Expenses previously recorded in Box 2. We continue to report Prior Year Adjustments (Box 4), Grants and Scholarships (Box 5) and Adjustments to Grants and Scholarships for a Prior Year (Box 6).

Please be aware that the purpose of the 1098-T is to support any claim for educational credit. The amount reported in Box 1 is for informational purposes and might be different than the amount you actually paid or are deemed to have paid. To learn more, see IRS Publication 970 – Tax Benefits for Education, or consult your tax professional.2

Frequently Asked Questions

A: All 1098-T forms are available for printing online through your SSB Account.

Instructions for accessing 1098T information on line:

- Go to https://mnu.edu/portal

- Click Self-Service Banner

Click on the Enter Secure Area – Login link and log in with your MNU account username and password. Your login is the beginning of your MNU email address. Your password is the last six digits of your social security number unless you have changed it. - Select the Student Services.

- Select Student Account.

- Select the Tax Notification.

- Enter the Tax Year and click Submit.

A copy of the 1098T Form will come up, as well as the date produced and the detail of how the figures were arrived at.

A: Beginning with tax year 2018, we began reporting in Box 1 the amount you paid during the year that applied to Qualified Tuition and Related Fees.

You may also find it helpful to pull your Account Activity from Self-Service Banner:

- Go to https://mnu.edu/portal

- Click Self-Service Banner

Click on the Enter Secure Area – Login link and log in with your MNU account username and password. Your login is the beginning of your MNU email address. Your password is the last six digits of your social security number unless you have changed it. - Select the Student Services.

- Select Student Account.

- Select Account Summary by Term

This will show all charges, payments and aid for your student account.

A: We account for all payments received in 2023 that were applied to Qualified Tuition and Related Fees billed by the University in 2023 (January 1st through December 31st only). Health Insurance charges, Room & Board are NOT considered to be qualified expenses as per the IRS.

A: Payments applied to your account during 2023 (January 1 through December 31) that total up to the Qualified Tuition and Related Expenses assessed in the 2023 tax year.

They include all payments from all sources, such as:

- Individual cash, check and credit card payments

- Payments from 529 and other investment accounts

- Payments from 3rd parties sponsors such as UTC, VA, DCF, etc.

- Student loans

- Grants and scholarships

Any refunds you received or any payments made that were returned by the maker’s bank are reflected as a reduction of these total payments.

- Housing Deposits

- Scholarships/grants earmarked for charges other than Qualified Tuition and Related Expenses such as housing, meals or books

- Tuition and fee waivers, which are reported to the IRS as a reduction to Qualified Tuition and Related Expenses

A: Mandatory tuition and fee charges that posted during the 2023 tax year (January 1 through December 31) for Spring 2023 term through Spring 2021 term, will no longer appear on the 1098-T form, but are reported to the IRS. If your Winter or Spring 2023 term charges posted in tax year 2022, they were reported in 2022 and are NOT included in 2023. Charges for housing, meals, transportation and insurance are NOT included.

Any tuition and fee waivers you received are reported as reductions of these total charges.

A: Payments recorded in Box 1 cannot exceed the total qualified charges reported in 2023. Additionally, payments made for Fall Term 2021 or earlier terms, are not reported, as the charges associated with these payments were reported in the 2021 or prior tax years.

- Grants and scholarships

- Payments from 3rd parties sponsors such as UTC, VA, DCF, etc.

Students can view the detail behind these amounts from their Self-Service Banner account.

Instructions for accessing 1098T information on line:

- Go to https://mnu.edu/portal Click Self-Service Banner

- Click on the Enter Secure Area – Login link and log in with your MNU account username and password. Your login is the beginning of your MNU email address. Your password is the last six digits of your social security number unless you have changed it.

- Select the Student Services.

- Select Student Account.

- Select Account Summary by Term

This will show all charges, payments and aid for your student account.

A: These are reductions made in 2022 to amounts previously reported to the IRS.

Other Pertinent Information

Overview of the tax credit

- A student (or the taxpayer who claims him as a dependent) may claim a tax credit for the amount paid for qualified educational expenses during a year

- American Opportunity Credit or the Lifetime Learning Credit provided in the Taxpayer Relief Act of 1997 (TRA 97) and The American Recovery and Reinvestment Act of 2009 (ARRA)

- Income limitations apply

- Student must be US citizen or resident alien

Overview of IRS regulations

- Have to report if at least a half-time student at any time during the year

- Have to report if a graduate student at any time during the year

- Have to report dollar amounts for:

- All payments applied towards Qualified Tuition and Related Expenses (Box 1)

- Amounts of scholarships and grants (Box 5)

- Adjustments to amounts reported in prior years (Box 4 and Box 6)

- Have to indicate whether the amounts reported include amounts for terms beginning in three months of next calendar year (Box 7)

- Students must be supplied 1098T by January 31, 2023

- We must report above information to IRS by March 31st.

- Don’t have to report if:

- Student not enrolled for the calendar year being reported.

- No reportable transactions occurred in the year being reported.

- Student is not a citizen or permanent resident, unless the form is requested.

- No academic credit received during reporting period.

- Taking only non-credit courses (such as IELP).

- Student Qualified Tuition and Related Fees are covered entirely by grants, scholarships, or waivers.

Resources for the taxpayer

- Consult their tax advisor

- Publication 970

- Form 8863

- Publication 5197

- Education Credits–AOTC and LLC

Additional Information & Notices

10/3/18 – Change of Reporting Method for Tax Year 2018 – Box 1 Reporting Required for 2018 Tax Year

In previous years, your 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with the tax year 2018 reporting, we will report in Box 1 the amount of QTRE you paid during the year.

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970.

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

MidAmerica Nazarene University is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser.

For more information about Education Credits AOTC and LLC, visit https://www.irs.gov/credits-deductions/individuals/education-credits-aotc-llc.

The Student Accounts & Cashiers Office is located on the 1st floor of the Lunn Building. Their office hours are Monday through Friday 8:30 a.m. to 4:30 p.m. except Tuesday when they open after Chapel at 10:45 a.m. Phone: 913-971-3504